Difference between Money Weighted Return and Time Weighted Return?

Very often students of

finance are confused between Time

Weighted Return and Money Weighted

Return. In this article we have tried to clarify both of them and also show

how both these type of returns differ from each other.

This article highlights

how the timing of the returns earned on the portfolio affects the overall financial

position. In other words it is not just the size of the returns that has to be

considered but also the timing of the returns while assessing the overall

returns on the portfolio. We would explain this phenomenon with the help of examples covering two 2

concepts-Time Weighted Rate of Return and Money Weighted rate of Return.

Time Weighted Return (TWR)

It allows an investor to

directly measure their portfolio’s true performance and compare the

performances of different money managers over a given time frame.It

computes the return for each period and takes the average of the results. It

finds the holding period for each period and averages them. If the investment

is for more than one year, the geometric mean of the annual returns is taken to

find the time-weighted rate of return for the measurement period.

Let us explain this with an example:

Suppose we have 3 annual returns of -10%, +15% and +5% then

the average (time weighted) return after the 3 years can be calculated as

follows:

Average time-weighted = [(1+ r1) ´

(1+r2)´ (1+r3)]^(1/3)-1

=

[(1-10%) ´ (1+15%) ´

(1+5%)]^(1/3)-1

=

[0.9´ 1.15 ´ 1.05]^(1/3)-1

=

2.81% per annum

It is interesting to note that when working with time weighted

returns, the order in which the returns occur does not matter. Let us change r1

and r3 around. Then we get:

Average

time-weighted = [(1+5%) ´ (1+15%) ´

(1-10%)]^(1/3)-1

= [1.05 ´ 1.15´

0.9]^(1/3)-1

= 2.81%

per annum

We get the same answer because we have applied the same weighting

to each return item, which in this case, was based on the amount of time it

applies to i.e. one year. Hence the name “time-weighted”

returns.

In general, the arithmetic and time-weighted average returns do

not provide the same answers, because computation of the arithmetic average

assumes the initial amount invested to be maintained (through additions or

withdrawals) at its initial investment value. The time weighted return, on the

other hand, is the return on a portfolio that varies in size because of the

assumptions that all proceeds are reinvested.

Money-Weighted Return

When it comes to what one actually ends up with in his/herkitty,

time-weighted returns is mostly irrelevant. This is wheremoney-weighted return

is the correct measure of returns and this is where the timing of the returns

affects the final result.It is defined as the internal rate of return on a

portfolio taking into account all cash inflows and outflows. The IRR is the

discount rate that equates the ending investment with the compounded value of

the beginning market value as well as all net contributions made during the

life of the investment.

The

MWRR can be calculated by solving the expression below for r(T)...

MW(T) = MV(0)´ {1+r(T)}T + sum [C(t)´

{1+r(T)}{T-t}]

MW(T) : Ending market value portfolio

MW(0) : Beginning market value portfolio

T : Ending time T

r(T) : IRR at time T over time period {0,T}

C(t) : Net contribution at time t

Note

that the time period (0,T) is assumed to be divided in n equally spaced time

periods. Other formulas with different time conventions exist.

Let us look at two

different members of the same retirement fund.

Mr.

A just started his first job and has started saving towards retirement. His

starting assets are therefore Rs 0. Let us furtherassume that he contributes Rs10

000 at the end of each of the next 3 years. Mr. B is nearing retirement and

thus far accumulated Rs750 000. He also contributes Rs10 000 at the end of each

of the next 3years.Both Mr. A and Mr. B are invested in the same balanced fund.

Scenario 1

Now

let us assume the annual returns on the balanced fund over the following 3

years are:

Year

1 -10%

Year

2 +15%

Year 3 +5%

What

is the average return earned on their assets? And what are the total assets

after 3 years?

For

Mr. A his total assets are Rs32575.00 which implies an average money-weighted

return of 8.35% per annum.

For

Mr. B his total assets are Rs847637.50 which implies an average money-weighted

return of 2.88% per annum.

Scenario 2

Now let us change the annual returns of year 1 and year 3 around

and perform the same calculations:

Year 1 +5%

Year 2 +15%

Year 3 -10%

What is the average return earned on their assets? And what are

the total assets after 3 years?

For Mr. A his total assets are Rs29350.00 which implies an average

money-weighted return of -2.18% per annum.

For Mr. Bhis total assets are Rs844412.50 which implies an average

money-weighted return of 2.75% per annum.

Summary of

results

|

|

Scenario 1

|

Scenario 2

|

|

Time-Weighted Returns

|

2.81%

|

2.81%

|

|

Mr. A Money-Weighted Returns

|

8.35%

|

-2.18%

|

|

Mr. B Money-Weighted Returns

|

2.88%

|

2.75%

|

The reason for the big difference in money-weighted returns for

Mr. A is the fact that he had Rs0 in the first year and was therefore not

affected by the first years' results. When the negative return of -10% was

earned in the 1st year, he was not affected at all and only benefited from the

two positive years. However, when the negative year followed when his

accumulated assets was at its highest level i.e. in the last year, the effect

was devastating, bringing his total return into negative zone. This is because

now the return is not based on time, but on the amount of money it is applied

to. Hence the name "money-weighted"

returns.

As we can see, Mr.B was also affected but not as much as Mr. A.

The reason for this is that his assets in year 3 compared toher assets in year

1 was relatively similar which means that the effect of the returns was

similar, even though it was worseunder Scenario 2 when the negative return was

applied to a higher asset value.

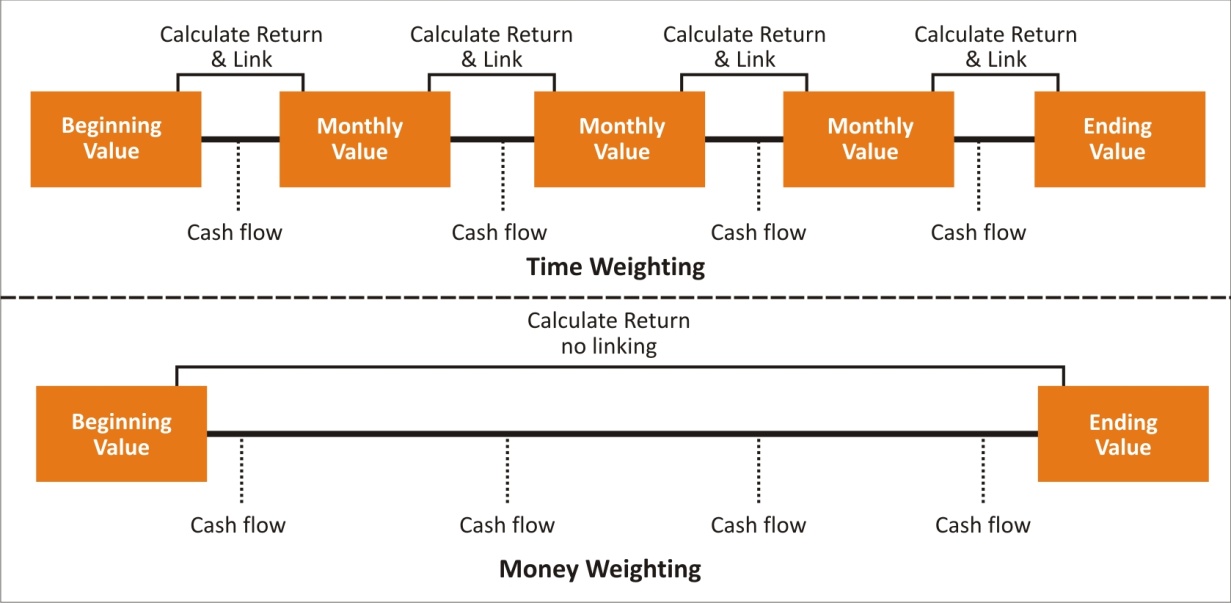

Graphical

Representation of Calculation of TWRR and MWRR

SNAPSHOT

|

Point of Distinction

|

TWR

|

IRR

|

|

Definition

|

Time Weighted Return measures the compound rate of

return over a given period for one unit of money.

|

A Money Weighted Return measures the compound growth rate

in the value of all funds invested in the account over the evaluation period.

|

|

Timing of Cash Flows

|

TWR is not affected by the timings of the external cash flows.

|

MWR is sensitive to the timing

of external cash flows

|

|

Usage

|

Time-weighted return is the superior measure for evaluating

public fund managers with no control over the

size or timing of cash

flows.

|

MWRR

is used for private fund managers because they typically exercise a degree of

control over the amount and timing of fund cash flows.

|

ADVANTAGES

AND DISADVANTAGES OF TIME AND MONEY WEIGHTED RETURNS

Advantages of using Money Weighted Rates of

Return:

Investors

can easily determine if they are making a consistent month on month return and

place an equivalent interest rate value on the return. If you are not

generating a consistent return, your internal rate of return will fall. There

can be no doubt about the importance of making a consistent return over time,

because as time goes by, the value of money depreciates due to the effects of

inflation.

Ideal for

comparing investment performance over time regardless of the size of the

investment or when you deposit or withdraw money; for example the Internal Rate of

Return is ideally suited to comparing the performance of stocks within a

portfolio, or comparing your portfolio with a given market index such as the

NIFTY or SENSEX.

Disadvantages of using Money

Weighted Rates of Return:

They are not suited to determining the change in the portfolio value

between two consecutive dates within a given date range.

Advantages of using Time Weighted

Rates of Return

It enables investors to determine rates of return independent of when

capital is added or withdrawn from the available investment fund. More commonly

this relates to fund managers and not private investors, as fund managers have

limited control over when they receive funds from investors, or when the

investor choose to withdraw their funds.

Ideally suited to environments where you have shared ownership, as they

enable ownership to be allocated based on the value of the assets and the

amount invested or withdrawn at any point in time.

Relatively simple to understand and calculate; for example when using the

Unit Valuation System the unit value is the sum of the assets divided by the

number of units in circulation. If you want to invest more money, you simply

buy more units at the current unit value. This is primarily used in all mutual

fund schemes.

Disadvantages of using Time

Weighted Rates of Return

They do not factor in how long money has been invested and therefore when

it was invested. As an investor, the Money Weighted Return measures, such as

the Internal Rate of Return enable you to track your performance over time. For

example the Unit Value might reflect that you have made a return of 100% but if

your unit value does not consistently increase, you can find yourself in a

position where your Internal Rate of Return is falling month after month, which

results in your investment capital devaluing with time.

Time Weighted metrics are not suited to comparing investment

performance for different investment portfolio.

....