All NPV, IRR, MIRR, XIRR and XMIRR are used to analyze investments and to choose between 2 investments. These measures allow an investor to find out the rate of return he is earning on his investment.

All NPV, IRR, MIRR, XIRR and XMIRR are used to analyze investments and to choose between 2 investments. These measures allow an investor to find out the rate of return he is earning on his investment.

NPV is a number and all the others are rate of returns in percentage.

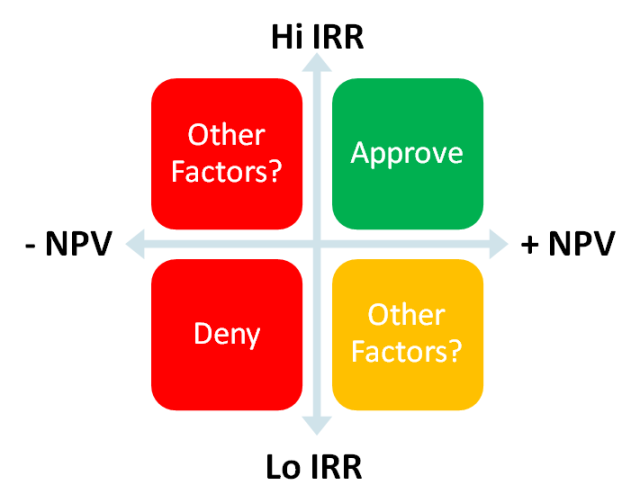

IRR is the rate of return at which NPV is zero or actual return of an investment.

MIRR is the actual IRR when the reinvestment rate is not equal to IRR

XIRR is the IRR when the periodicity between cash flows is not equal

XMIRR is the MIRR when periodicity between cash flows is not equal

Net Present Value (NPV)

Net Present Value is the current value of a future series of payments and receipts and a way to measure the time value of money. Basically, money today is worth more than money tomorrow. And future money is discounted by the interest rate you specify.

Assuming cash flows occur at the end of each period, an NPV with a 10% discount rate would divide the cash flow of period 1 by (1 + 10%) then add the cash flow in period 2 divided by (1 + 10%) ^2, etc. The NPV calculation ends with the last cash flow. The formula for NPV is:

where N is the number of periods, n is a specific period, C is the cash flow for a particular period and r is the discount rate for each period.

So in NPV we find the present value off all cash outflows i.e. all the money invested and then we find the present value of all cash inflows i.e. returns generated by an investment. The we subtract cash outflows from cash inflows. The resultant answer is called as NPV or Net Present Value. The rate used to find the present value is called as the ‘Discount Rate’ and it is the opportunity cost the return which would be generated if this investment is not chosen.

Suppose for an investment is Rs. 1500 at 10% discount rate this means that after generating a return of 10% the money remaining is Rs. 1500 i.e. the return is more than 10%.

Please remember to set the Discount Rate to Your Time Interval

The discount rate you enter must correspond to the period of time between each cash flow. For periodic cash flow analysis, Total Access Statistics does not have date information on when the events occur.

If it’s monthly, you should use 1/12th of your annual rate, for quarterly one-fourth, etc. For most accurate results, take the nth root of your annual discount rate to capture the compounding effect.

Internal Rate of Return (IRR)

The Internal Rate of Return is used to measure an investment’s attractiveness. It is the interest rate that makes the NPV equal to zero for the series of cash flows. At least one negative payment and one positive receipt are required to calculate IRR. If this doesn’t exist, the result is null.

IRR is sometimes called the discounted cash flow rate of return, rate of return, and effective interest rate. The “internal” term signifies the rate is independent of outside interest rates.

Depending on the number of cash flows and their values, IRR can require many iterations to generate an accurate result. Microsoft Excel stops after 20 tries.

Suppose for an investment @ 12.24% discount rate the NPV is zero it means after generating 12.24% return no money remains that means that actual return is 12.24% this actual return is called IRR.

IRR is based on the following assumptions:

- The investment is held till maturity.

- All intermediate cash flows are re-invested at IRR

- The cash flows should be periodic i.e. the time interval between two cash flows are equal.

How to calculate?

Enter your Investments (amount which you paid) in each row (you have to put “-” before each value)

Enter the Amount you Received at the end (put “+” after that amount)

Formula: =IRR(values)( place your values put the range of cells which contains values) see below:

Things to NOTE

The values need to be a set of Positive and Negative Values

The last value is the amount you receive

Any amount Invested will be Negative so if you invest Rs 10000, put -10000

Any amount you Receive will be Positive so if you get Rs 5000, put +5000

All the payment or receiving of money are equidistant, Like 1st of every month OR May 15th Every year

All the payments are assumed to be yearly by default.

If its’ some other time frame like monthly or quarterly use XIRR and put specific dates.

XIRR IRR when periodicity of cash flow is not equal

What is XIRR and How to Calculate it?

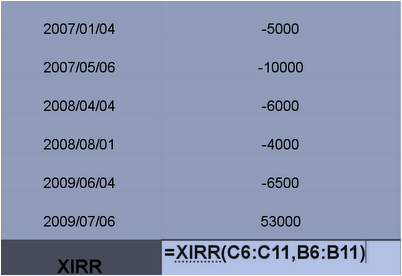

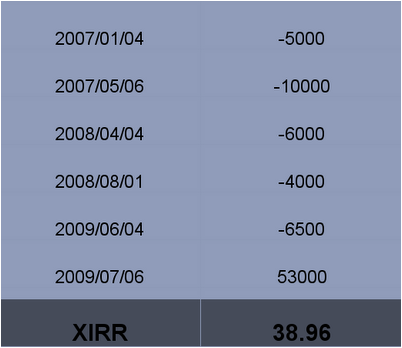

IRR does not solve one problem and that is when the payments are at Irregular interval. In that case we use XIRR. So in a Spreadsheet we put the date and the value both. See the example below:

How to Calculate

Put Date and Value for each row

At the last row put the Date and amount you received

Put the formula as: =XIRR(values, dates), values and dates are the cell ranges

Use this Spreadsheet to calculate XIRR for yourself

In the above example the CAGR Return was 38.96% (I have multiplied the return by 100 the actual value will be .3896)

Real Life scenario when you can use it:

Scenario 1:

Suppose you Invest in a Mutual Funds per month on your own , you invest on 15th of every month in year 2006

June 15 you invested 5000

July 15 you invested 6000

Aug 15 you invested 3000

Sep 15 you receive 5000 (dividend)

Oct 15 you invested 4000

Nov 15 you invested 12000

Dec 15 you Sell everything and Receive 35000

You can use IRR in this case and calculate your returns , the values you will be -5000 , -6000 , -3000 , +5000 , -4000 , +12000 , Calculate the IRR and put it as comments , lets see if you are correct or not ?

Scenario 2

You can also compare two business ideas using the XIRR , and decide which one is better than other . In any business concept you have to invest money and you get back some return , but these returns can be irregular and different amount every time , In that case you can use XIRR and compare the returns of both business and decide the one which has better XIRR

Note: the formula can give answers in a but different ways on Excel , OpenOffice spreadsheet , google docs or Zoho Spread sheet . Use this Spreadsheet to calculate IRR and XIRR for yourself . The spreadsheet is shared , so please dont make any changes other than “values” and “dates” .

Modified Internal Rate of Return (MIRR)

Modified Internal Rate of Return is used to measure an investment’s attractiveness. MIRR is a modification of the IRR calculation and resolves some problems with the IRR.

IRR assumes that positive cash flows are reinvested at the same rate of return as that of the investment. This is unlikely as funds are reinvested at a rate closer to the organization’s cost of capital or return on cash. The IRR therefore often gives an overly optimistic rate of the cash flows. For comparing projects more accurately, the cost of capital should be used for reinvesting the interim cash flows.

Additionally, for projects with alternating positive and negative cash flows, more than one IRR may be found, which may lead to confusion.

To use MIRR, provide the two interest rates:

- Finance Rate: the cost of capital

- Reinvestment Rate: the interest received for cash investments

Similar to the discount rate provided for NPV, these rates should be the rate for each period and not the annual rates if your periods are not yearly.

The formula for MIRR is:

where n is the number of equal periods at the end of which the cash flows occur (not the number of cash flows), PV is present value (at the beginning of the first period), FV is future value (at the end of the last period).

MIRR sums the discounted negative cash flows to the starting time, and sums the positive cash flows to the final period adjusting for the reinvestment rate. By dividing and taking the nth root, it determines the rate of return for the positive and negative cash flows.

Note that in Excel or VBA, the MIRR function always assumes the cash flows are at the beginning of the period. If you want to use the End of period option in Total Access Statistics and compare it to Excel, add an extra cash flow of zero to the beginning of the Excel data set.

Modified X Internal Rate of Return (XMIRR)

MIRR is a modification of the IRR calculation and is a more accurate reflection of the true rate of return for a series of cash flows. MIRR where dates are taken into account is called XMIRR.

To calculate XMIRR, provide the two interest rates:

- Finance Rate: the cost of capital

- Reinvestment Rate: the interest received for cash investments

AND

The date of cash flow

So if we calculate modified IRR for a irregular cash flow then it become XMIRR.

Unlike periodic cash flows, the rates for irregular cash flows are always the annual rate.

....