Tax Equivalent Return

Vs. After Tax Return

While

evaluating taxable returns vs. tax-free returns, an investor needs to compare

the numbers on common platform. The Tax-Equivalent Return formula can help an

investor decide if a tax-free investment will give him a better return than a

taxable investment.

While

evaluating taxable returns vs. tax-free returns, an investor needs to compare

the numbers on common platform. The Tax-Equivalent Return formula can help an

investor decide if a tax-free investment will give him a better return than a

taxable investment.

Tax Equivalent Return: is the return an investor would

have got after adding the tax benefit on a tax free return.

So

Tax

Equivalent Return = Tax Free Return(%) + Tax Benefit (%)

This Tax Benefit would depend on the Tax Slab an Investor falls into. That means

two investors can look at the same Tax Free Investment but have different Tax

Equivalent Returns if they fall into different Tax Brackets.

The higher the Tax Bracket of an Investor higher would be the Tax Equivalent

Return.

After Tax Return: This the actual return an investor

makes after deducting the tax on a taxable investment. Or it is the return net

of taxes.

So

After

Tax Return= Stated Return (%) - Tax Outgo (%)

Formula and Examples of Tax Equivalent Return and After Tax Return

The Tax

Equivalent Return

formula states the tax-free return

in terms of what an investor need to earn on a taxable investment to have the

same return post taxes. The tax-equivalent return will be higher for investors

in the higher tax brackets.

The tax equivalent return formula is used to compare the return between a

tax-free investment and an investment that is taxed.

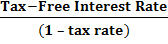

Tax-Equivalent Return = Tax-Free Interest Rate ÷

(1 – tax rate)

The

After Tax Return is the actual

return after adjusting the taxes to be paid on a taxable investment.

After Tax Return = Taxable Interest Rate × (1 –

tax rate)

We will now highlight the difference between TER (Tax Equivalent Return) and

(ATR) After Tax Return by an Example

Suppose an investor has the choice between two fixed-income options:

A

6.50% taxable return or a 5.25% tax-free return. The Tax rate for the investor

is assumed to be 30%.

So, now the question is which one of the two options should the investor choose?

We would use the formula of Tax-Equivalent Returns in order to arrive at a

common comparison mode. The formula is:

Tax-Equivalent Return =

Putting the above figures in the formula:

=

=

= 7.50% =TER

This means that if the investor falls in the 30% tax bracket, then he needs to

find a fixed income investment that yields AT LEAST 7.50% BEFORE TAX in order to

get the same after-tax return of a 5.25% tax-free. In this case the investor

would be in a much better position purchasing the tax-free option.

The same thing can be looked from another angle. We again assume that the

investor falls in the tax bracket of 30% tax bracket and you find an investment

with a taxable return of 7.50%. Since this return is taxable, the investor would

not get to keep it all. So, a smart investor needs to calculate how much of that

return is going to be left after taxes.

So, we can perform the following calculation, which is an alteration of the

formula used above:

After Tax Return = Taxable Interest Rate × (1 – tax rate)

= 7.50 × (1 – .30)

= 7.50 × .70

= 5.25%

This is how both the concepts work

We can also calculate what the After-Tax Return is on the 6.50% return:

= 6.50 × (1 – .30)

= 6.50 × .70

= 4.55%

So which one out of 5.25% tax-free or 4.55% tax-free would be chosen by an

investor is an easy question to be answered.

What needs to be noted is that the higher the tax bracket of an investor, the

more advantageous a Tax-free return becomes for him. We can have a look at the

graphic to illustrate the same concept:

|

Tax Bracket

|

Tax Free Return

|

Tax Equivalent Return

|

|

10%

|

5.25%

|

5.83%

|

|

15%

|

5.25%

|

6.18%

|

|

20%

|

5.25%

|

6.56%

|

|

25%

|

5.25%

|

7.00%

|

|

30%

|

5.25%

|

7.50%

|

|

35%

|

5.25%

|

8.08%

|

Can

we compare a Tax Equivalent Return and After Tax Return to judge which is better

investment?

Can

we compare a Tax Equivalent Return and After Tax Return to judge which is better

investment?

The answer is no.

We can compare a Tax Equivalent

Return to a Stated Before Tax Return.

We can compare a Tax Free Return

with an After Tax Return

Therefore it is very important for investors to

understand the meaning of Tax Equivalent Return and After Tax Return and the

comparison between two returns can be made only before the tax considerations or

after tax considerations. Also because difference in Tax Slabs what may look good for a high-income

investor in higher tax bracket may not necessarily be good for lower income

investor in lower tax bracket.

....