GLOBALLY #1 & ONLY CERTIFICATION IN TRUST & ESTATE PLANNING IN INDIA

The Chartered Trust and Estate Planner® (CTEP®) offered by American Academy of Financial Management India designation expands your range of services to include estateplanning, inheritance planning and asset repositioning services for your clients.

An estate planning designation like internationally acclaimed Chartered Trust and Estate Planner® demonstrates to your peers, clients and prospects that you are serious about your profession. After all, someone seeks the services of another because that person believes the other can do a better job. Prospective clients are less likely to engage you if they believe you know the same or less than they do about the topic at hand. This is where the specialist enters.

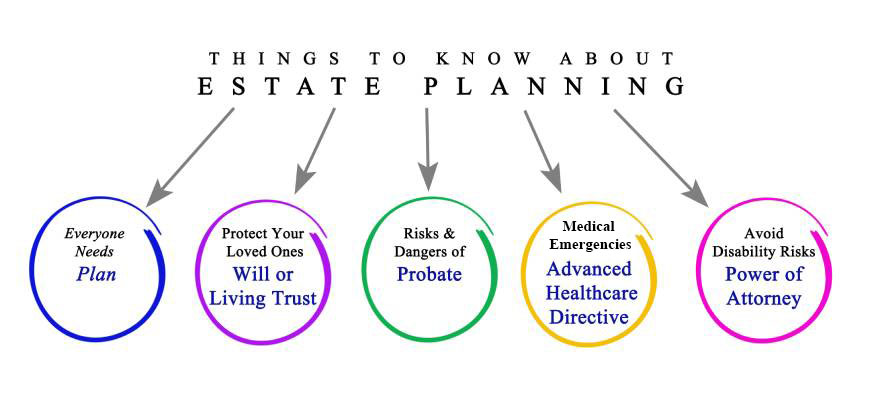

With CTEP® knowledge and strategies, you can offer expert guidance on:

- Succession Planning

- Wills and Probates

- Asset Protection Trusts

- Special Child Protection Strategies

- Incapacity Financial Asset Protection

- Guardianship Issues

As you master these topics and tools, you also gain the confidence to secure your clients’ assets for generations to come.

How will CTEP® course benefit You?

Enables you to provide a professionalservice of a higher standard

Enhances your ability to give holistic adviceto clients as a trusted advisor

Distinguishes you and your firm from the competition

Enhance your knowledge of all aspectsof Estate & Succession Planning including the vehicles, legal structures,principles and practices underpinning it

As a result of successfully completing the Certificate, you will be able to:

- identify how aspects of Personal Law such as succession laws, guardianship laws, bankruptcy, adoption, divorce, etc. affect a client’s estate and inheritance planning.

- use the technical legal language underpinning private client matters

- explain the salient features and benefits of making a will and how dying intestate affects the direction of a client’s wealth

- explain the processes involved in administrating a client’s estate and the executor’s role

- describe the variety of trust structures commonly found in private client work in India

- describe the key regulatory aspects relating to India trusts and the obligations of trustees under the India Trust Act

- describe the use and appropriateness of testamentary trusts and declaration of trusts

- describe the principles governing Muslim estates and the use of various Muslim-compliant estate planning tools

- explain the purpose and use of insurance trusts in legacy planning

- use buy-sell agreements cum trusts in business succession

- describe the continuance of trust investments and the trustee’s duties and responsibilities

- describe the tax treatment of trusts in India and its impact on the different stakeholders

- outline the scope and use of the financial durable power of attorney and appointment of deputies and how they can be affected

- understand philanthropic planning and the charities law framework in India.

How will this course benefit your employer?

As a result of successfully completing this Certificate, you will:

- increase your knowledge and understanding of the legal and tax factors of estate and inheritance planning

- enhance your ability and confidence in structuring and implementing the wealth distribution plans of your clients

- gain a qualification recognizedacross 151+ Countries of more than 300000+ , a group comprising the most respected experts working in the fields of trusts, tax and probate.

In addition, you will also be more confident when discussing with other professionals’ issues relating to the use of trusts, business succession planning, in estate planning.

Why Financial Advisors Should Pursue the CTEP® Certification?

Wealth Transfer is one of the biggest concerns of your Top Clients!

If you do not provide your client with estate planning, who will? Will the other person try to redirect investment business to someone else or possibly make unfavorable remarks about the client's portfolio composition or point out how easy it would be to save income taxes by investing in X instead of Y? The financial advisor is considered the all in one man; keep control of the situation.

Once a client perceives you as an estate planning specialist, their view of you will be elevated-they will now think of you as a smarter and more accomplished person. Looking at you in a new light may result in the client have you oversee more of their assets or referring you to their parents, children or friends.

Benefits of Estate Planning Certification for Financial Advisors

1. Client's needs are about Wealth Enhancement, Wealth Protection and Wealth Transfer. So, to be complete advisors, they should incorporate Wealth Transfer Advise.

2. Estate Planning advise allows advisors to cater to higher level of clients and broaden their range of services and client base.

3. The advisor gets complete share of Wallet.

4. The advisor gets the ability to continue his services to the next generation.

5. With transaction or commission margins under pressure it allows an additional source of income.

6. Estate Planning is the most ignored area of Personal Finance and there is virtually no competition, so it gives a competitive edge to advisors who incorporate it.

Financial Advisors frequently feel becoming a specialist is too time consuming, especially during periods of economic extremes. CTEP Certification offers flexible schedules and self-study programs. Most importantly, this is a one-time commitment. You can lose money in stocks or bonds, but no one can take away your education

Request More Information

Request More Information